Say goodbye to clunky direct debits and the waiting game for payments! Australia has entered the era of real-time, secure, and convenient payments with the arrival of PayTo.

PayTo is a modern and Innovative digital payment solution offering a fast, easy and secure way to pay. It gives consumers more visibility and control over their payments, and enables merchants and businesses to initiate real-time payments from their customers’ bank accounts, offering a win-win situation for both consumers and businesses.

What is PayTo ?

In simpler terms, PayTo is a digital payment system that allows businesses to initiate real-time payments directly from your bank account. This initiative of new digital payment system from New Payment Platform Australia (NPP) and Australia’s financial services industry enables an easy way to authorise and control payments from your bank account. Think of it as a smarter, faster, and more secure version of direct debit. No more paper forms, manual approvals, or waiting days for the money to clear.

Here’s what makes PayTo special:

- Real-time Payments: No more waiting days for your bills to clear. PayTo transactions happen instantly, ensuring faster cash flow for businesses and peace of mind for consumers.

- Enhanced Security: Each PayTo agreement is authorized within your secure banking app, minimizing the risk of fraud and unauthorized payments.

- Greater Control: You have complete control over your PayTo agreements, allowing you to easily set up, manage, and cancel them directly from your bank account.

- Flexible Use Cases: PayTo isn’t just for bills. It can be used for a variety of transactions, from online shopping and subscriptions to one-off payments and even payroll.

How does PayTo work?

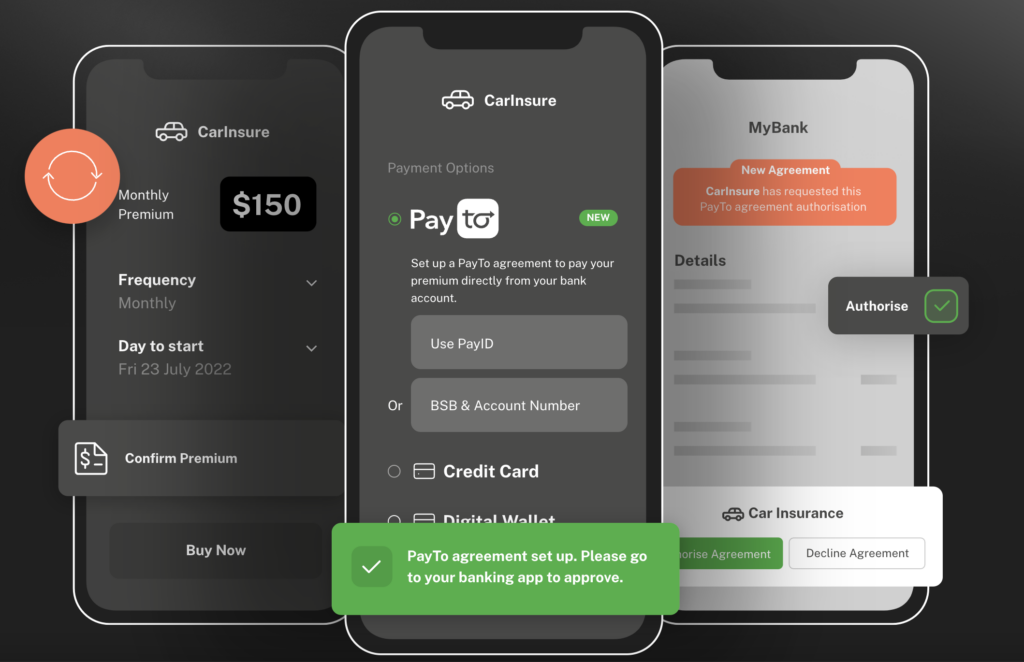

A business or merchant will set up and initiate a ‘PayTo agreement’ with the customer. The PayTo agreement will appear in customers internet or mobile banking app for authorisation. Customer will authorise how much, and when to pay for goods or services. It could be for a one-off, ad-hoc, or recurring payment. Once the customer has authorised the agreement, the business can debit your account according to the agreed terms.

image reference: payto.com.au

Benefits to Consumers

- Say goodbye to late fees: With instant payments, you’ll never miss a payment deadline again.

- Increased control over your finances: Manage your PayTo agreements directly from your bank account, giving you complete visibility and control over your spending.

- Enhanced security: PayTo transactions happen within your secure banking app, minimizing the risk of fraud and unauthorized payments.

- Convenience: No more scrambling for credit card details or dealing with multiple payment methods. PayTo is simple and easy to use.

Benefits for Businesses

- Faster cash flow: Get paid instantly, improving your cash flow and financial planning.

- Reduced failed payments: Say goodbye to the frustration of declined direct debits and chargebacks. PayTo agreements ensure authorized payments.

- Improved customer experience: Offer your customers a convenient and secure payment option, boosting customer satisfaction and loyalty.

- Streamlined operations: Automate recurring payments and simplify your billing process with PayTo.

How Payto addresses some of the challenges with Direct Debit

- Real-time account validation when setting up a PayTo agreement increases confidence in receiving payments and reduced exception processing. In Direct debit there is no upfront validation of customer account details leading to uncertainty of receiving payments.

- Payto’s Real-time payment processing and confirmation of payment outcomes enables improved cash flow for the business. Direct debit would usually take upto 3 business days for the same.

- PayTo agreements contain more information and data that enables better matching and easier reconciliation.

- PayTo digitally stores the agreements in centralised and secured way, which are readily accessible. This reduces the administrative burden and overheads. With Direct debit agreements they are meant to be self-stored for seven years.

The Future of Payments:

PayTo is just the beginning of a revolution in real-time payments for Australian payment industry. This innovative system has the potential to transform the way we interact with money, making transactions faster, safer, and more efficient for everyone. As PayTo becomes more widely adopted, we can expect to see even more innovative applications and benefits emerge.